Overview

This report provides an in-depth analysis of 1hat's competitive positioning in the digital healthcare market, identifying market size & growth, user adoption & behavior, key weaknesses, market challenges, and areas of improvement

Key Metrics Analyzed

- Market Size: Estimated market value for the Digital Care Health Market

- Market Share: key players and their percentage of share

- Competitor User Base & Revenue: Total app downloads, active users, and revenue generated in Tier 1 & Tier 2 cities

- Competitor Penetration: Presence in urban vs. semi-urban markets and its ability to scale against established players

Market Positioning & Differentiation Issues

Crowded Market with Strong Competitors- The healthcare-tech space is highly competitive, with established players like Practo, 1mg, Tata Health, Apollo 24/7, and PharmEasy already dominating

- 1hat lacks clear differentiation—many of its services (doctor booking, medicine delivery, digital records) are standard features across competitors

Limited Brand Recognition

Limited Brand Recognition

- Unlike big healthcare platforms, 1hat has low market awareness and lacks a strong brand presence

- Competing platforms already have customer trust, backed by hospitals, insurance providers, and major pharmacy chains

Service-Specific Weaknesses

Family Health Coach – Passive Engagement Risk- Users may not actively engage with the platform beyond initial setup, leading to high drop-off rates

- Major competitors offer AI-powered health tracking, doctor chatbots, and symptom checkers, which provide more real-time value

- Storing sensitive health data raises serious privacy concerns, and without strong encryption guarantees or regulatory approvals, users may hesitate to trust the platform

- Competitors like DigiLocker (government-backed) and major hospital networks already offer secure and integrated record storage

- Doctor and diagnostic bookings rely on external hospital networks, which might be inefficient or unreliable

- Lack of direct tie-ups with hospitals puts 1hat at a disadvantage compared to major competitors like Apollo and Practo, which have their own hospital chains or strong partnerships

- Doctors may be unwilling to participate without strong incentives or high consultation fees

- Medical compliance issues—real-time health advice over chat/calls may pose legal risks if misused

Customer Experience & Monetization Risks

Customer Retention & Engagement Challenges- Many users may download the app but never actively use it if reminders and concierge services don’t provide ongoing engagement

- Competing apps offer loyalty rewards, discounted teleconsultations, and pharmacy discounts, which 1hat lacks

- Subscription-based models in healthcare face resistance, as users prefer free services or pay-per-use models

- Medicine delivery and concierge services have low-profit margins, making it harder to scale without additional revenue streams

Key Metrics Analysis & Insights

Market Size and Growth- Current Valuation: In 2023, India's digital health market was valued at approximately USD 3.88 billion

- Projected Expansion: The market is expected to reach around USD 39.70 billion by 2032, with a compound annual growth rate (CAGR) of 29.5% between 2024 and 2032

- Tata 1mg: Emerging as a market leader, Tata 1mg held a 31% market share in 2023, surpassing competitors like PharmEasy

- PharmEasy: Once a dominant player, its market share declined to 15% in 2023

- Other Notable Competitors: Platforms such as Practo, Lybrate, and Netmeds also contribute significantly to the market, offering a range of services from online consultations to medicine deliveries

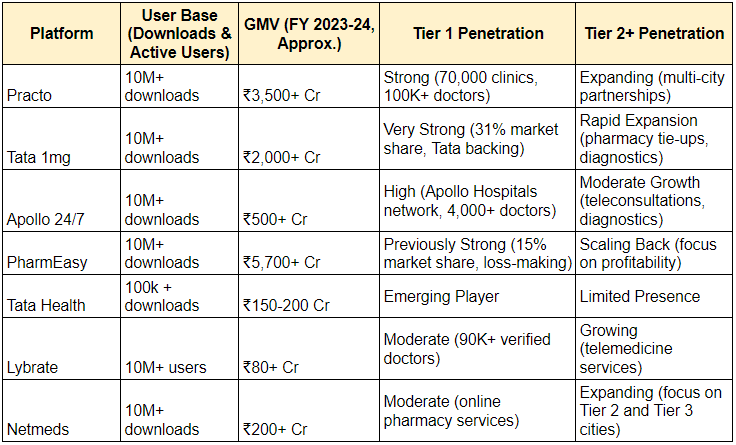

Competitor User Base & Revenue

Competitor User Base & Revenue

- Digital Health Startups: India hosts over 816 domestic digital health startups, making it the second-largest digital health ecosystem globally

- Venture Capital Investment: The sector attracted $7.92 billion in venture capital funding over the past decade, indicating strong investor confidence

- Service Utilization: There's a growing trend of users adopting telemedicine, online pharmacies, and digital health records, especially accelerated by the COVID-19 pandemic

Market Potential

- Digital Health Startups: India hosts over 816 domestic digital health startups, making it the second-largest digital health ecosystem globally

- Venture Capital Investment: The sector attracted $7.92 billion in venture capital funding over the past decade, indicating strong investor confidence

- Service Utilization: There's a growing trend of users adopting telemedicine, online pharmacies, and digital health records, especially accelerated by the COVID-19 pandemic

Action Plan for Improvement

Short-Term Strategies- Strengthen hospital partnerships – Secure exclusive tie-ups with top hospitals & diagnostic centers for better service reliability

- Improve user engagement tactics – Introduce gamification, health rewards, and premium content access to boost retention

- Enhance data security compliance – Obtain HIPAA, GDPR, or national health data compliance certifications to increase trust

Key Outcomes & Achievements

1

Tier 1 Cities exhibit higher adoption rates of online health platforms - Approximately 38%

2

Practo holds the largest market share across 70,000 clinics and hospitals, serving over 100,000 doctors across more than 22 specialties.